Making Medicare Easy.

Speak with a Licensed Insurance Agent | 1-888-321-6361

Texas Medicare Supplement Plans

Most Texans know that their Original Medicare coverage alone is not enough and the out of pocket expenses that Parts A and B of Medicare leave behind are simply to high for their budget.

This is why many Medicare beneficiaries in Texas choose to purchase a Medicare Supplement Plan, also known as Medigap policies. Medicare Supplement Plans are sold by private insurance companies and help by paying most or all of the health care costs that Original Medicare (Medicare Part A & B) doesn’t cover.

The expenses that Supplement plans cover include co-payments, coinsurance, deductibles and excess fees. These types of plans help you fill the gaps in your medicare coverage, ensure you have a very predictable healthcare budget, and lower your out-of-pocket spending.

Compare 2024 Medicare Plans

Not sure which Medicare plan is right for you? We will provide you with a side-by-side comparison from top-rated insurance companies so you can make an informed decision when it comes to your Medicare coverage.

Learn How To Find the Best Medicare Supplement Rates!

We’ll show you how to easily compare plans side by side and explain the most important things to look for in your new Medicare Supplement coverage.

Compare Medicare Supplement Plans Available in Texas

There is truly no one supplement plan that is best for everyone so finding the best Medicare supplement plan for you starts with knowing exactly what to look when selecting your coverage. Here are a few of the most important tips that will help you find the insurance company and plan that will offer you the greatest coverage for the most affordable price.

Why Plan G Is So Popular In Texas

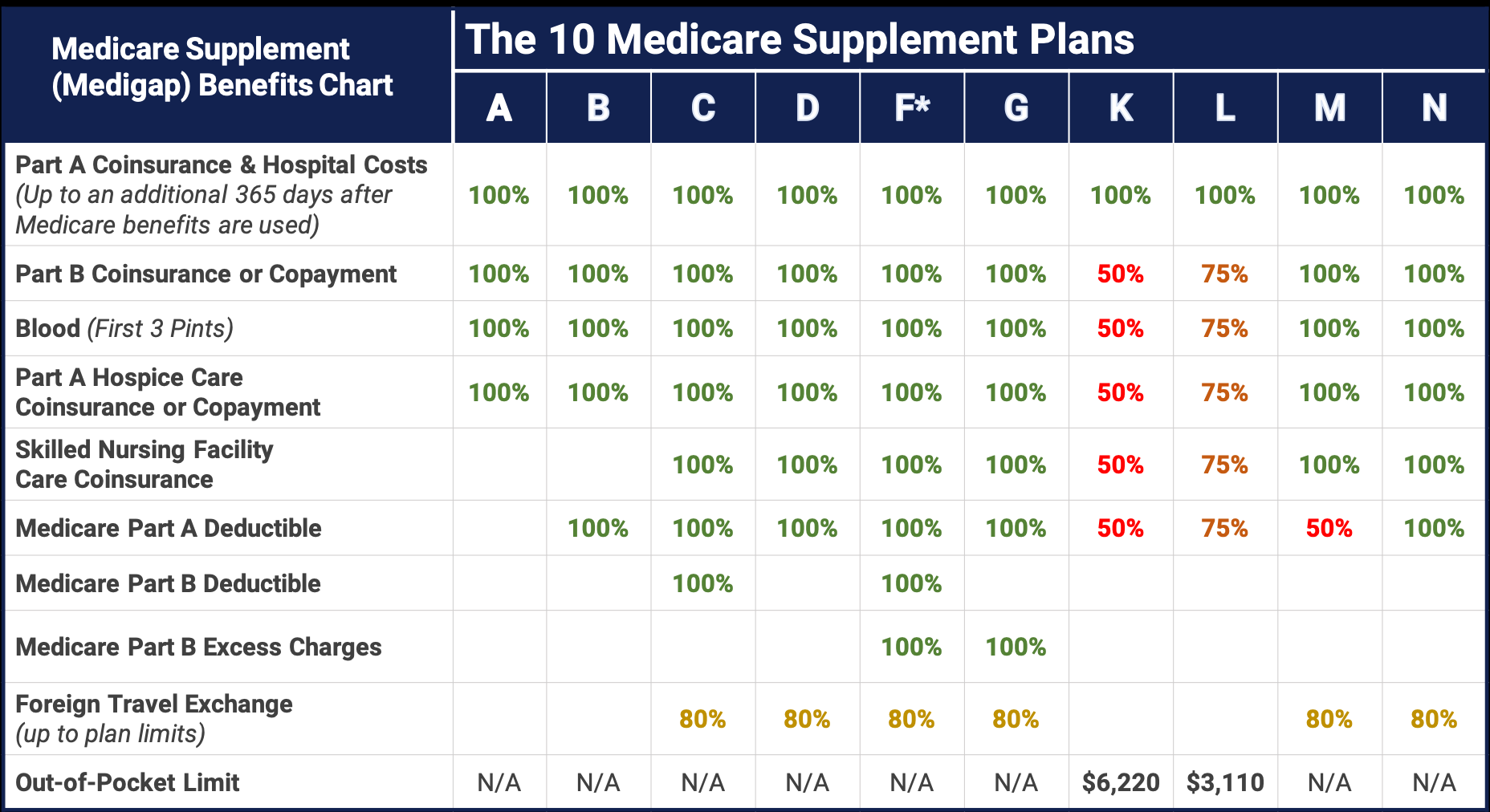

There are 10 different Medicare Supplement plans available in Texas that insurance companies are allowed to offer. These plans are named with letters such as Plan G, Plan F, Plan N, and so forth. Out of these 10 plans, Plan G usually offers the best value when you compare the benefits it offers for the price making it one of the best Medicare supplement plans available in Texas. You can learn more about Plan G and why it can be a great value in the following article: Plan G vs Plan N

Medicare

Super Hint!

All Medicare Supplement companies must provide the exact same benefits for each plan type but prices will vary between companies. Once you have selected a plan we can help you shop the market for your best price!

Supplement Plans Are Standardized

Once you have selected which plan you want to go with, such as Plan N or G, then the next big tip is to shop around to see which insurance company offers that plan for the lowest price. This is especially important because all insurance companies in Texas are required to offer the exact same coverage for each plan. The only thing they are allowed to change is the price they charge for the coverage!

The benefits from plan to plan are the same from every insurance company. This means that the benefits that Plan G provides will be the same no matter which insurance company you choose.

Want to learn how to get the best deal possible on your new coverage? Read this article that explains how to save money on your Medicare Supplement premiums.

Prices Will Vary Between Insurance Companies

One last reason to make sure and shop around before purchasing your plan is that premiums for new applicants are based on your age, sex, tobacco use, and location. This means the best supplement insurance company for someone in Dallas may be different then for someone living in Austin, Fort Worth, or Huston. So don’t over pay for your coverage, be sure to shop around and find the best rates available in Texas for you, especially since each insurance company is providing the same benefits.

Compare 2024 Medicare Plans

Not sure which Medicare plan is right for you? We will provide you with a side-by-side comparison from top-rated insurance companies so you can make an informed decision when it comes to your Medicare coverage.

CONTACT

ADDRESS

14140 Midway Rd #150,

Dallas, TX 75244

PHONE

HOURS

MON – FRI: 8:30 AM – 6:00 PM

SAT – SUN: Closed