Which Medicare Supplement Plan Is The Best?

One of the most common questions we receive at Medicare Hero is which supplement plan is better, Medicare Plan N vs. G? If you’re wondering the same thing, then follow along as we explain the difference between Plan G and Plan N so you can make a well-informed decision when choosing your Medicare coverage. Let’s get started by talking about the basics of how Medicare Supplement plans work.

Compare Medicare Plans

We have been helping clients save money on their Medicare coverage for over 30 years.

Let us do the shopping for you and show how much you could be saving on your monthly premiums!

How Do Medicare Supplement Plans Work?

Before we discuss what the difference between Plan N and Plan G is, there are two main key points that are first important to understand:

#1 | There are no networks for Medicare Supplement Plans

This means that you can use any doctor or any hospital in the country that accepts Medicare, regardless of which Medicare Supplement Plan you choose. Additionally, there are no referrals required. Meaning you can see any doctor without any doctor referrals to see them.

#2 | All Medicare Supplement Plans are standardized

Meaning that every insurance company must offer identical coverage. For example, Medicare Supplement Plan G offered by Company A is the exact same as Plan G offered by Company B. The coverage is the same, no matter which company you choose. So you might be asking yourself… So then, what’s the difference between companies? The difference is the price you pay.

What Is The Difference Between Medicare Plan G and Plan N?

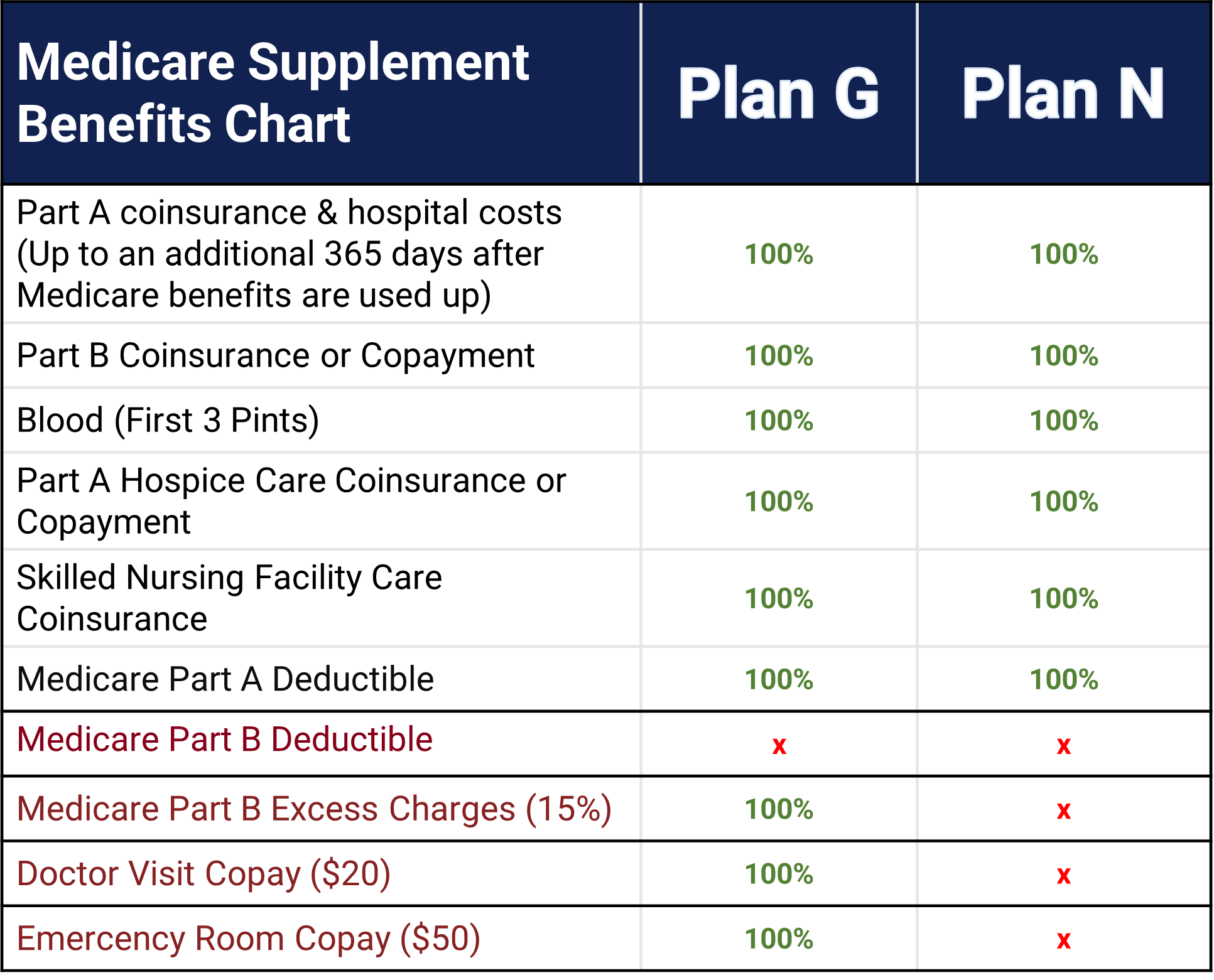

First let’s discuss what is Medicare G Plan and what does it cover? Previously, Plan F offered the highest level of supplemental insurance available until it started to be phased out at the beginning of 2020. Now that Plan F is no longer available for new Medicare beneficiaries, the highest level of Medicare Supplement coverage available is offered by Part G. Let’s take a look and see what does Medicare Plan N cover? What Medicare Plan G covers? And finally, is Medicare Plan G is better then Plan N? Take a look at the comparison chart of Medicare supplement plans below:

Medicare Part B Deductible

You may be wondering, does Medicare Supplement Plan N cover Part B deductible? Unfortunately, the simple answer is no. Both Plan N and Plan G do not cover the small annual Part B deductible of $226. This means when you go to the doctor the first time at the beginning of the year, you will have to pay this $226 deductible out of pocket with either of these plans.

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we’ll cover next.

Doctor Visit Copay

As you can tell from looking at the chart, all doctor visit copays will be 100% covered by Plan G. But, on the other hand, with Medicare Plan N benefits, you must pay a $20 copay for every doctor visit you go to. So, ultimately, if you are a person who visits the doctor frequently, this could definitely add up over a year.

Emergency Room Visit Copay

Like doctor visits, if you chose Plan G, there will be no additional copays for unexpected ER visits. However, with Part N, there will be a $50 copay for every ER visit.

Medicare Part B Excess Charges

This is one of the most important coverage differences between the two plans that could cost you a lot more in medical bills than expected. So Plan N does not cover any excess charges, while Plan G does. So what this means if you choose Plan N, medical providers can send you a balance bill if that provider does not accept Medicare’s assigned rates. As a result, they can bill you up to 15% more than Medicare’s allowed rates. This can get very expensive if you aren’t careful.

Excess Charges Explained

Medicare Assignment is basically a “fee schedule” or “agreement” between Medicare and a doctor. Accepting assignment by a doctor means that your doctor agrees to the payment terms set forth by Medicare. If your doctor has not accepted Medicare Assignment, then Medicare allows them to bill you up to 15% more than the Medicare Allowable amount. As mentioned above, Plan G covers those excess charges while Plan N does not.

This is the only way to avoid being hit with those excess charges. But remember, this is only applicable if you choose Plan N. If you have Plan G, you won’t have to worry about excess charges since they are covered.

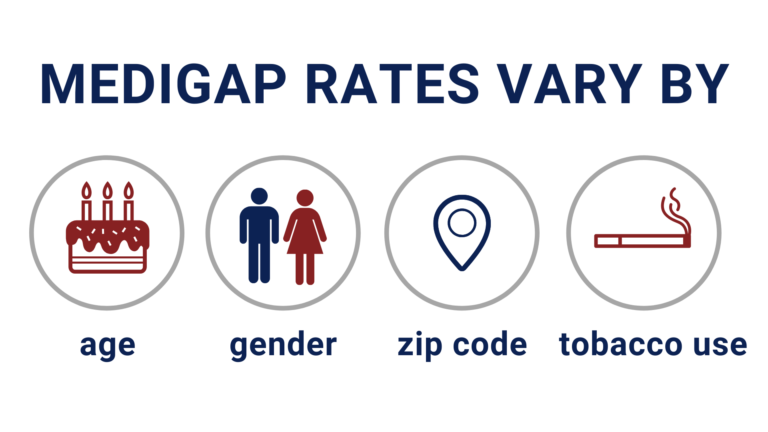

What Are My Rates Based On?

The rates for Medicare Supplement don’t just vary from company to company; plan rates also vary tremendously across the United States, and more importantly, from person to person. Medigap Rates are typically based on your age, gender, zip code, and tobacco use.

The Cost of Medicare Plan G vs Plan N

Medicare Supplement Quote You might be wondering what the cost of Medicare Plan N vs. the cost of Medicare Plan G; as that can be a great factor for which plan you choose. Since Medicare Part N does not provide the same amount of coverage as Plan G, clearly, you will have a lower Medicare Plan N cost. However, the difference in cost is minor. In most cases, the cost of Medicare Plan N will be an average of $15 – $30 per month less than Plan G. To see a real-life example and get a behind-the-scenes look at the quoting software we use, click on this video HERE.

Which Medicare Supplement Plan is Best?

It gives you the most coverage and doesn’t save you a substantial amount compared to Plan N. However, if you’re someone who doesn’t visit the doctor often or plan to in the future. Overall you’re a really healthy person; this might be a good choice for you if you’re on a really tight budget.

However, if you only went to the doctor once a month, with that $20 co-pay, that’s going to pretty much discount the savings in premiums than you would have with Plan N, and it still leaves you exposed with the ER copay and the excess charges that you might incur.

Even if you go to the doctor a few times a year, we typically see Plan G providing the best value. Because, for even for $15 – $30 more, you don’t have to worry about any unexpected out-of-pocket expenses for any Medicare services, other than that $226 deductible.

Request Your Free Rate Comparison

Once you decide which Medicare supplement plan is right for you then the next step is to compare insurance companies to find the lowest rate. Our team at Medicare hero makes shopping for Supplemental coverage easy!

Simply click the button below and we will send you a personalized rate comparison so you can see the prices different companies are charging. Our help is completely free so feel free to reach out to us for help today!

The Stress Free Guide To Medicare!

Great information doesn't have to be complicated! This guide is designed to cut through thousands...

Medicare Webinars Are Now Available!

If you are going to be new to Medicare soon and have you ever wondered...

See What Our Clients Have to Say About Us…

LaJan B.

5-Star Review via Facebook

“First, the webinar was so informative and easy to understand. It was a great place for me to start. Then Brooke followed up by answering all my questions, giving me information that pertains to me, and helping me get everything in order. I’m sure I would have struggled (for a long time) without the help highly recommend Medicare Hero.”

Sue S.

5-Star Review via Facebook

“I just got back from my appointment at Medicare Hero to set up the various supplemental plans I’ll be using when I hit 65 in the near future (we also worked with Medicare Hero last year for my wife). They simplify the entire process wonderfully, and can give you multiple plans to choose from with price comparisons. There is absolutely NO pressure (indeed, they don’t even charge a fee) and they make a complicated situation easy. I would (and will!) happily recommend Medicare Hero to my friends!”

Susan M.

5-Star Review via Facebook

“As you approach retirement age, you’ll receive a constant barrage of mail telling you about hundreds of various medical coverage options and policies. Hugely confusing, just because of the volume if nothing else. Medicare Hero is a wonderful guide through the barrage, helping you find the most suitable coverage at the best cost. They’ll give you several choices, explaining the gotchas and relative advantages and disadvantages of the “best of the lot”, and help to prevent you from making mistakes you’ll regret later. HIGHLY recommended!”

Gordon P.

5-Star Review via Facebook

“Watched the webinar video and felt like they were real people not fake Salesmen… so I called them and worked with Chet Kuhn, was amazed at the service, could tell I was dealing with an honest man full of integrity! Would recommend this company to everyone! Was dreading this entire ordeal of Medicare/supplement plans and he made it so easy!”

Leave a Reply