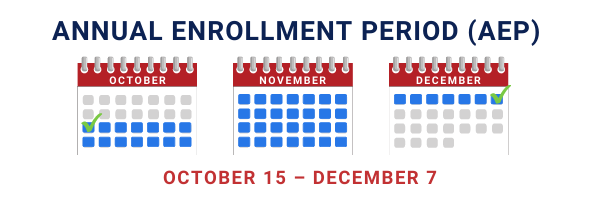

The 2023 Fall Medicare Annual Enrollment (also known as the Fall Open Enrollment period or Annual Election period) runs from October 15 – December 7 every year.

We understand this time can be stressful; we recommend taking baby steps beforehand to help prepare for the AEP. We promise it will make your life a lot easier when October 15th rolls around! In this article, we’ll provide you with some helpful tips to make your AEP period go as seamless as possible.