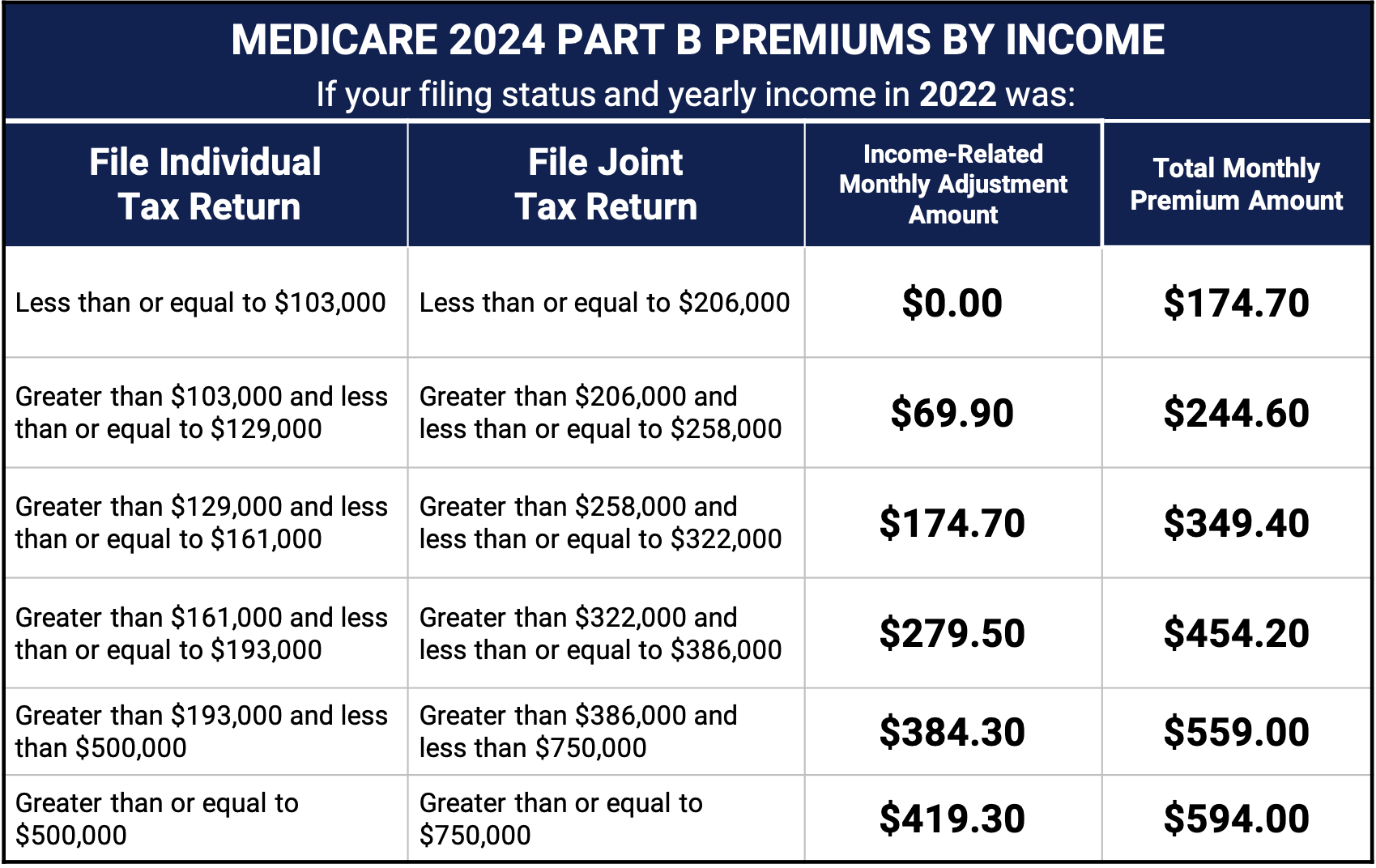

Part B Medicare Costs

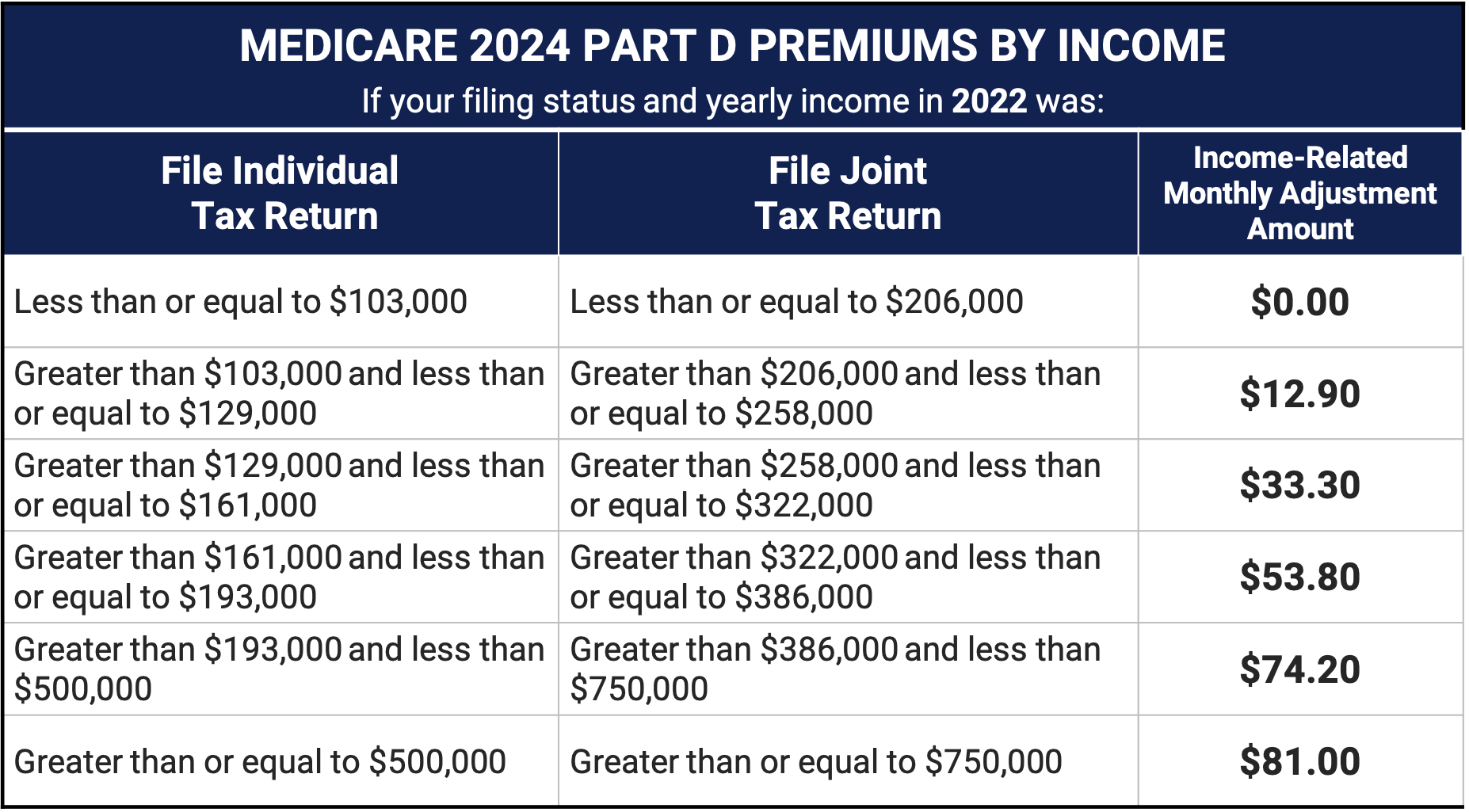

Premiums for Medicare Part B are based upon your modified adjusted gross income (MAGI) from 2 years ago; since this is the most recent tax return information provided to Social Security by the IRS. Items that contribute to your MAGI include: wages, interest, required minimum dividends from investments, capital gains, Social Security benefits, and tax-deferred pensions. Medicare uses your tax return from 2 years ago to determine what you’ll pay for Medicare Part B and Part D. (Part D drug plans premiums are also based on income.)