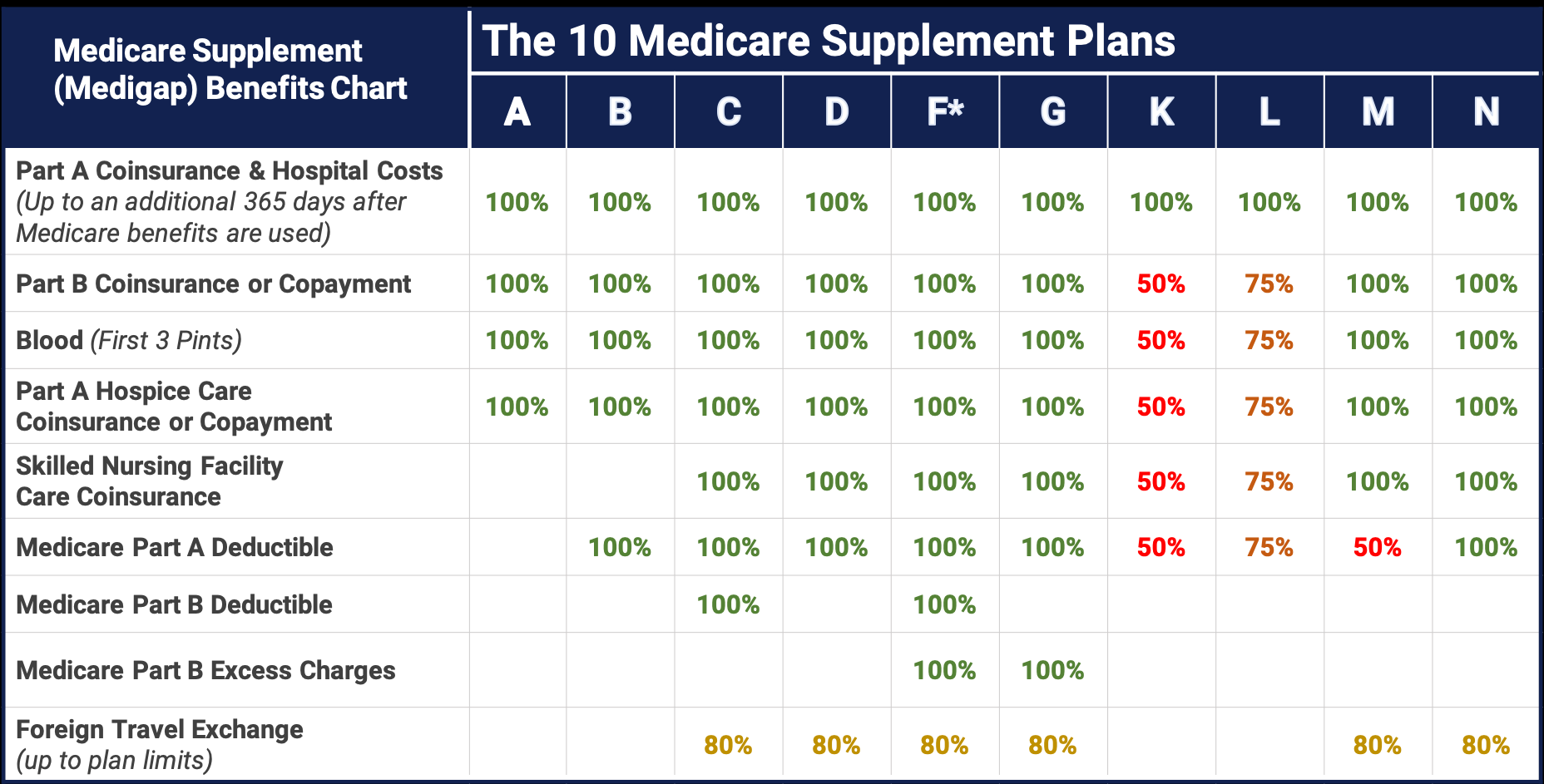

Medicare Supplement Plans

Medicare Supplement Plans, also known as Medigap policies, are sold by private insurance companies and will pay some or all of the health care costs that Original Medicare (Medicare Part A & B) doesn’t cover. Supplement plans were created to cover the gaps in Medicare that you would normally have to pay. These costs can include copayments, coinsurance, deductibles and excess fees. These types of plans help make your annual health care budget very predictable and lower your out-of-pocket spending.